Hey, welcome back! It’s Jason Walter here, and in today’s video, I’m going to discuss a hot topic: home prices during this pandemic. So let’s go ahead and jump right into the video.

A lot has changed over the past two months. For example, over 38 million people in the United States have filed for unemployment benefit claims within the last nine weeks. The stay-at-home orders have ground the economy to a halt. Additionally, the Dow Jones Industrial Average is down about 10 percent year-to-date. Trillions of dollars in stimulus funds were approved by the US government, and thousands of homeowners took advantage of the mortgage loan forbearance program. It’s been reported that about 9 percent of all mortgages are currently in forbearance. This should all equate to the real estate market absolutely imploding, right? Well, think again.

I’ve done hours and hours of research on this topic, so if you wouldn’t mind, please hit the like button. I greatly appreciate that, and it also helps support this channel.

According to Zillow, the U.S. median home price for all housing types in April was $288,000, up 7.4% from April 2019. In Sacramento County, the median home price increased by 3.9% from April 2019 to April 2020. Additionally, the median home price was flat from March to April this year, not a decline. However, the number of home sales in the United States declined by 18 percent in April compared to the month before. According to CNBC, this was the largest month-to-month drop in the number of closings in the United States since July 2010. We’re seeing that in Sacramento County as well. For example, sales volume, which is the number of houses sold, decreased by 13.8 percent from March to April this year.

So why aren’t home prices declining? After all, during the Great Recession about 12 years ago, home prices absolutely tanked when the economy tanked as well. Let’s discuss why we’re not seeing home prices declining in today’s market. A main contributing factor is the low amount of housing inventory, which means a low number of houses available for sale. For example, Realtor.com stated that new listings declined by 28 percent compared to a year ago, and total listings dropped 20 percent year-over-year in the United States. With fewer options for home buyers, the demand for the houses currently listed for sale increases.

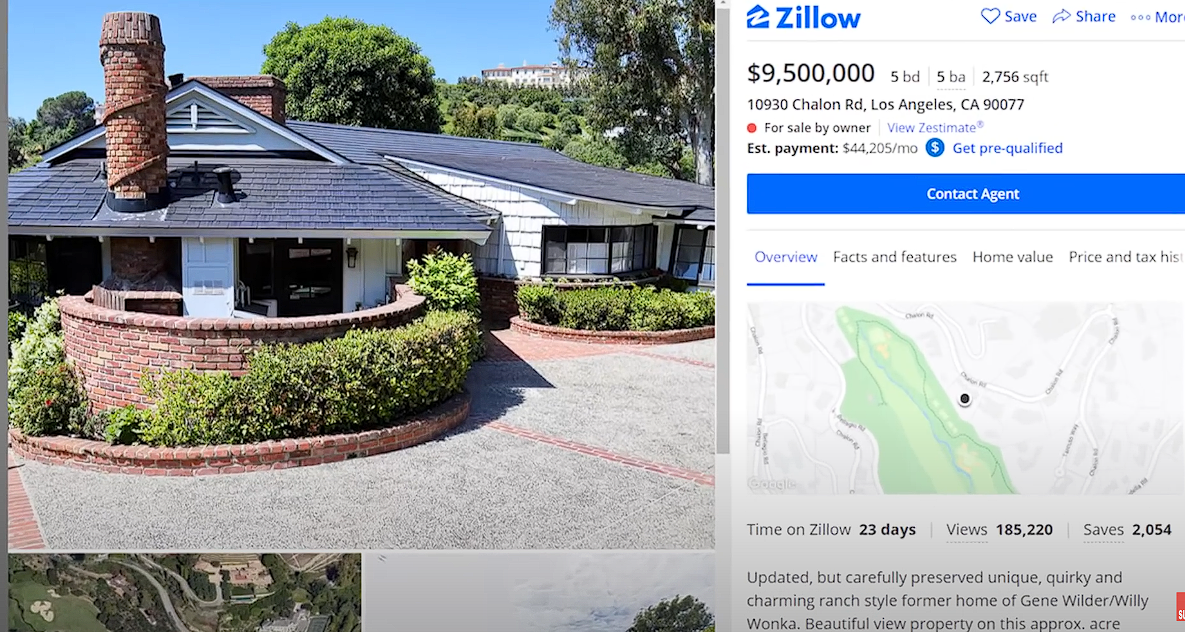

Let me share an example to explain this. Some of you may have heard of Bugatti’s hypercar called the La Voiture Noire. This car produces about 1,500 horsepower and has a top speed of 260 miles per hour. Only one of these cars was produced by Bugatti, making it the rarest modern Bugatti ever, and it recently sold for $18.7 million. By the way, rather than spending $19 million on one car, you could buy one of the houses that Tesla’s Elon Musk has for sale in Los Angeles, which is a 5-bedroom, 5-bath house overlooking a golf course for $9.5 million, and you’d still have $9 million left. Anyway, when you compare that $19 million Bugatti to a Bugatti Chiron, which also has 1,600 horsepower and a top speed around 260 miles per hour, you can buy a brand-new Chiron for about $3 million, which is $16 million less. The main factor here comes down to supply. Bugatti plans to produce around 500 Chirons, but only one La Voiture Noire. A low supply supports a high price.

Another example is the demand for toilet paper during this pandemic. We’ve all seen images online of people hoarding toilet paper and grocery stores running out. Are people going to the bathroom more now than before the pandemic? Of course not. People feared a shortage of toilet paper, so they bought everything in sight, causing a shortage. Then, people sold it on eBay for twice the cost. I know these are far-fetched analogies, but stay with me. Let’s compare the supply vs. demand relationship to real estate. If there are 20 percent fewer houses available for sale right now, that increases the demand for those houses, thus supporting the prices. Therefore, the price of anything is a function of the relationship between supply and demand. Because there’s less housing inventory right now, that increases demand for the houses available for sale.

Additionally, home buyer demand is fueled by record low interest rates. Right now, you can get a 30-year fixed mortgage for around 3.3 percent. Let’s compare this to mortgage interest rates over the last 50 years. This graph shows mortgage interest rates since 1971. Rates were around 18 percent in the early 1980s and around 6 percent in 2008 during the Great Recession.

So what happened to the real estate market at the start of this pandemic? Many home sellers decided not to list their houses or took them off the market. Some people were concerned about having strangers walk through their homes. Additionally, real estate agents weren’t allowed to meet with their clients face-to-face. The number of home buyers also dropped off. State home orders and the inability to meet with realtors to see houses in person for at least a month, depending on where you live, impacted the market. Additionally, some people lost their jobs or were furloughed and decided not to buy a house. Therefore, there was a drop in home sellers and home buyers early on in the pandemic. Traffic to sites like Zillow and Redfin dropped, and mortgage applications dropped significantly. This caused pending home sales to decrease, leading to a decrease in home sales as well. However, home prices remained steady.

In contrast, let’s compare this to the Great Recession. This graph shows the number of listings in light green over the last 15 years in nine major northern California counties. There were over 30,000 houses available for sale in 2007. Now, there are only about 5,000 houses available, which is about six times less than in 2007. In 2007 and 2008, there were way more home sellers than home buyers, creating a surplus of inventory, which caused a decrease in demand and ultimately led to home prices declining. When the financial collapse occurred, people lost their jobs, and millions of foreclosures flooded the market, further increasing inventory. This excess supply, with diminished demand, caused home prices to fall greatly.

In my opinion, this scenario will not play out again during this pandemic for three main reasons. First, housing inventory was already historically low before the pandemic. Second, interest rates are historically low right now. Compared to the Great Recession, interest rates were around 6 percent, about twice as high as they are now. Third, the U.S. government is taking steps to curb another foreclosure crisis.

Two weeks ago, the Federal Housing Finance Agency (FHFA) announced an extension of the foreclosure and eviction moratorium until at least June 30, 2020. The current moratorium was set to expire last week and was part of the CARES Act. This is great news because people are not losing their houses due to foreclosure or eviction during this pandemic. However, this foreclosure moratorium only applies to single-family mortgages owned by Freddie Mac or Fannie Mae. Additionally, the FHFA announced a payment deferral solution for those who have entered into a loan forbearance because of a financial hardship due to COVID-19.

If you recall, a mortgage loan forbearance allows a homeowner to either reduce or stop making mortgage payments for up to 180 days, plus an additional 180 days beyond that. Keep in mind that loan forbearance does not mean loan forgiveness. The big question mark is how homeowners who missed these loan payments will pay them back if they were experiencing a financial hardship due to COVID-19.

One new option is through this payment deferral program. This program allows homeowners to add their missed payments to the end of their mortgage term. However, this only applies to those with a federally backed mortgage. Additionally, the borrower’s monthly mortgage payment will not change. Therefore, the missed mortgage payments would be paid off by the homeowner when they either refinance, sell their house, or pay off their mortgage in full.

The FHFA also states that borrowers with COVID-19-related hardships can still utilize other options, including reinstatement, repayment plans, or loan modifications based on their individual situations. For those interested, loan servicers will begin offering this program starting July 1, 2020.

On top of this, the FHFA announced new guidance for creating a pathway for people who are in forbearance or have recently ended their forbearance to refinance or buy a new house. This is great news because many people were worried that entering into loan forbearance would affect their credit and disqualify them from getting a new house or refinancing their existing mortgage.

Let me briefly share how this program works because there are some eligibility requirements. You would only qualify if your mortgage is owned by Fannie Mae or Freddie Mac. According to Fannie Mae, homeowners who missed payments and entered into a loss mitigation solution, such as a repayment plan, a payment deferral, or loan modification, are eligible for a new refinance or purchase mortgage after three timely payments. In other words, if you were in forbearance but made three timely payments according to your payment plan, you may be eligible to refinance or purchase a new house. However, there is no waiting period if the homeowner has paid the full amount of the outstanding payments missed during the forbearance period or if they requested forbearance due to a COVID-19 financial hardship but made all payments in full and on time.

Lastly, the FHFA is approving the purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac. This provides liquidity to lenders