In 2022, the American personal saving rate fell to a low not seen since the Great Recession. The COVID-19 pandemic significantly altered financial behaviors and savings rates. People, cooped up during lockdowns, accumulated savings due to reduced spending opportunities. As restrictions eased, a surge in spending began, coupled with rising inflation, leading to a notable decrease in the savings rate.

The Pandemic’s Financial Impact

During the early part of the pandemic, many Americans accumulated significant savings. With stimulus checks and reduced spending on travel and leisure, personal savings rates soared. However, as the economy began to reopen, these savings started to be spent down.

Financial Stress and Savings

The dip in saving rates has caused financial stress for many Americans. A survey revealed that 70% of people are stressed about their personal finances, including 57% of individuals earning $100,000 or more annually. The main factors contributing to this stress are inflation, economic instability, rising interest rates, and a lack of savings.

Disparity in Savings

Despite the overall increase in savings during the pandemic, the distribution of these savings is uneven. Higher-income households have accumulated more savings compared to lower-income households. This disparity means that while some Americans are still financially better off than they were pre-pandemic, others are struggling more with basic necessities like housing, food, healthcare, and transportation.

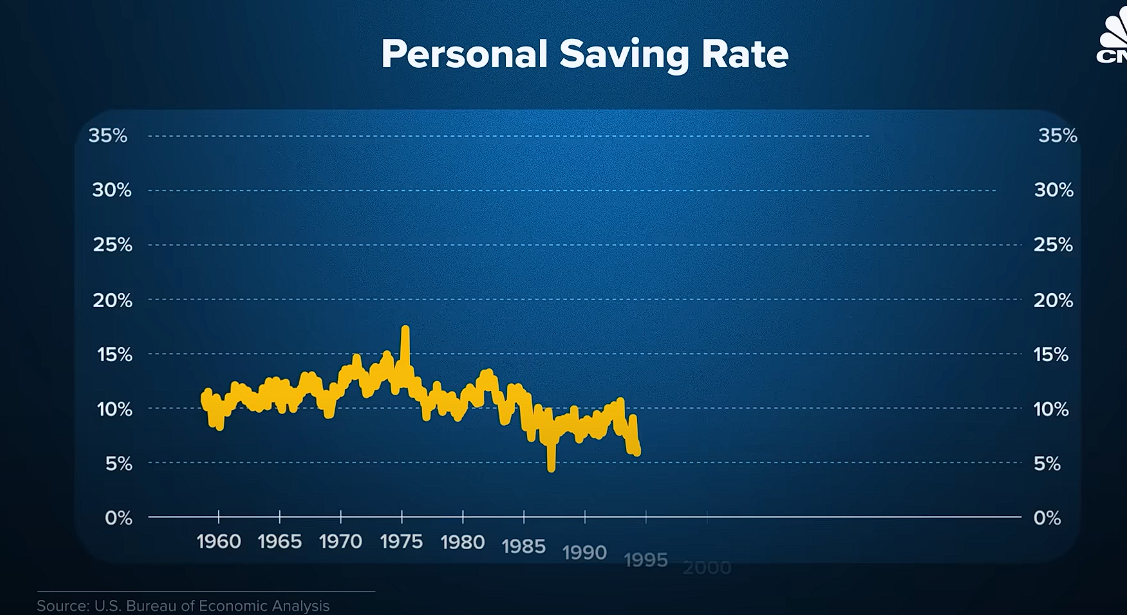

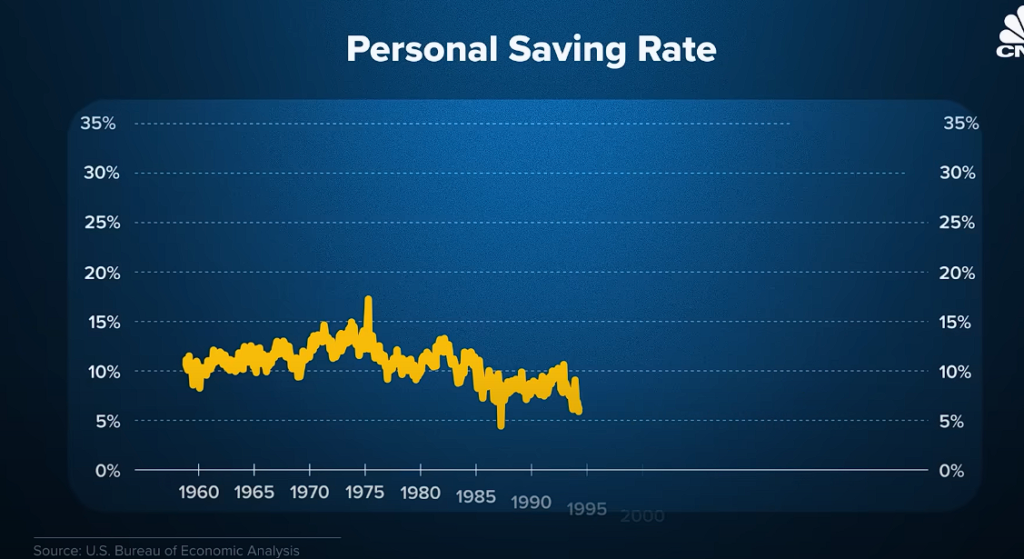

The Personal Saving Rate

In February 2023, the personal saving rate hovered around 4.5%, significantly lower than the long-term average of just under 9%. The pandemic’s early days saw spikes in saving rates due to stimulus checks and reduced spending. However, as inflation set in, the monthly saving rate tumbled, reflecting the strain on personal finances.

Excess Savings and Economic Impact

During the pandemic, Americans saved an estimated 2 to 2.5 trillion dollars more than expected. By early 2023, these excess savings had dwindled to 1 to 1.5 trillion dollars. This cushion of savings has helped to buoy the economy, especially in a consumption-driven country like the US. However, the top half of earners hold significantly more in excess savings than the bottom half, highlighting economic inequality.

Inflation and Its Effects

Inflation has significantly impacted savings. Rising prices for essentials like food, fuel, and rent have eaten into both current income and savings. This is particularly challenging for lower-income families, who may have very little financial slack to weather periods without income.

Consumer Sentiment and Recession Fears

Despite the savings cushion, many Americans are living paycheck to paycheck. A survey of 1,000 people found that 69% are pessimistic about the economy’s current situation and future prospects. This pessimism can lead to reduced consumer spending, potentially contributing to a self-fulfilling prophecy of recession.

Interest Rates and Savings

Federal economists note that low interest rates in recent years have supported Americans’ financial conditions. However, as these rates rise, the benefits of saving can increase. High-yield savings accounts offer better returns compared to traditional savings accounts, although they still may not keep up with inflation.

Bank Accounts and Savings Strategies

Many Americans are leaving money on the table by not seeking out high-yield savings accounts. Roughly 6 million Americans were unbanked in recent years, often due to a lack of trust in banks or insufficient funds. For those who do use banking services, high-yield accounts and certificates of deposit (CDs) can offer better returns on their savings.

The Importance of Saving

No matter the method, saving money is crucial. Even small amounts can grow through compound interest. It’s important to start saving, even if it’s less than desired. Building the habit of saving can lead to financial stability and resilience in the long term.

Conclusion

The decline in Americans’ savings rates post-pandemic highlights the financial challenges many face, from inflation to economic instability. While some households are better off than pre-pandemic, many are struggling to save amid rising costs. Understanding and utilizing high-yield savings options and maintaining a habit of saving, even in small amounts, can help improve financial security in the long run.