In this article, Education Loan we will share all the information related to education loans. We’ll cover where and how you can easily get an education loan, how to reduce interest rates, who should and shouldn’t take an education loan, and more. We’ll take the example of India’s largest bank, SBI, and explain the entire process to you. The procedure for education loans is generally the same across most banks. After watching this video, you shouldn’t need to watch any other videos related to education loans. I have personal experience with SBI education loans, having taken one for my own education.

My Personal Experience Education Loan

I will share information based on my personal experience. SBI broadly offers five categories of education loans:

- SBI Student Loan: For students who wish to study within India.

- SBI Global Advantage Loan: For students who wish to study abroad.

- SBI Scholar Loan Scheme: Available for students admitted to top colleges in India like IITs, IIMs, NITs, etc.

- SBI Skill Development Loan Scheme: For vocational courses.

- SBI Takeover Loan Scheme: For taking over existing loans from other banks.

Common Loan Schemes

We will discuss the first three schemes: Student Loan, Global Advantage Loan, and Scholar Loan, as these are the most common.

- SBI Student Loan: Offers up to ₹20 lakh for studying within India.

- SBI Scholar Loan Scheme: Provides up to ₹40 lakh for students in top colleges, divided into categories AA, A, B, and C. Loans can range from ₹7.5 lakh to ₹50 lakh based on the category.

- SBI Global Advantage Loan: For studying abroad, offering loans from ₹7.5 lakh to ₹1.5 crore.

Loan Amounts and Coverage

You can take a loan for higher education like graduation, post-graduation, vocational courses, and part-time courses. Loans are available only after securing admission to a college. For example:

- SBI Student Loan: Up to ₹20 lakh.

- SBI Scholar Loan Scheme:

- AA category: Up to ₹50 lakh.

- A category: Up to ₹40 lakh.

- B category: Up to ₹30 lakh.

- C category: Up to ₹7.5 lakh.

- SBI Global Advantage Loan: Up to ₹1.5 crore, covering tuition fees, hostel fees, and other educational expenses.

Collateral and Security

- SBI Scholar Loan Scheme: No collateral required.

- SBI Student Loan: No collateral up to ₹7.5 lakh. For higher amounts, parents need to be co-borrowers and provide collateral such as property or government bonds.

- SBI Global Advantage Loan: Requires collateral up to 110% of the loan amount.

Processing Fees

- SBI Scholar Loan Scheme: No processing fee.

- SBI Student Loan: No fee up to ₹20 lakh, above which a fee of ₹10,000 plus GST applies.

- SBI Global Advantage Loan: ₹10,000 plus GST.

Interest Rates

Interest rates vary and can change every few months. As of now:

- SBI Student Loan: 11.15%

- SBI Scholar Loan Scheme:

- AA category: 8.55%

- A category: 9.65%

- SBI Global Advantage Loan: 11.15%

For girl students, there is a 0.50% concession on the interest rate. The interest rate is floating, meaning it changes with RBI’s repo rate.

Loan Repayment and Moratorium Period

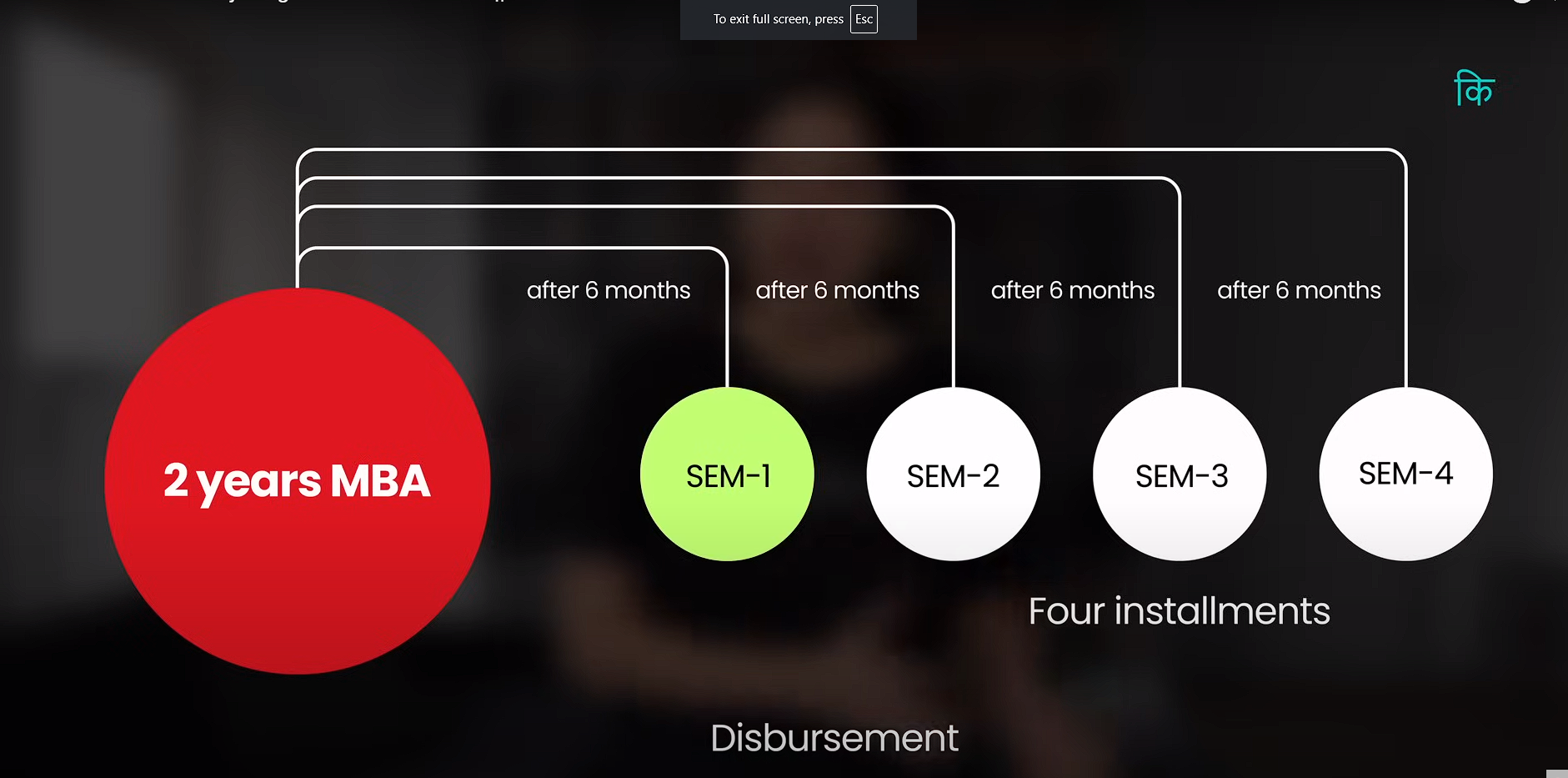

- Disbursement: The loan amount is disbursed in installments, typically corresponding to your semester fees.

- Moratorium Period: After completing the course, you get a one-year grace period to find a job before starting repayment.

- Repayment Tenure: Up to 15 years after the course and moratorium period.

Special Schemes

- Education Loan Subsidy Scheme: Available for economically weaker sections with a family income of less than ₹4.5 lakh per year. Not valid for students studying abroad.

Tips and Tricks

- Loan Insurance: Not mandatory. You can refuse it.

- Maximum Sanction Amount: Apply for the maximum amount possible for flexibility.

- Income Tax Rebate: You can get a rebate on the interest paid under Section 80E of the Income Tax Act for 8 years.