The Importance of Credit Utilization

Managing your credit utilization effectively is crucial for maintaining a high credit score. Credit utilization is the ratio of your current credit card balances to your total available credit limit. It is recommended to keep your credit utilization below 30% to avoid negative impacts on your credit score. If you exceed this limit, your credit score can drop significantly.

How Credit Utilization Affects Your Credit Score

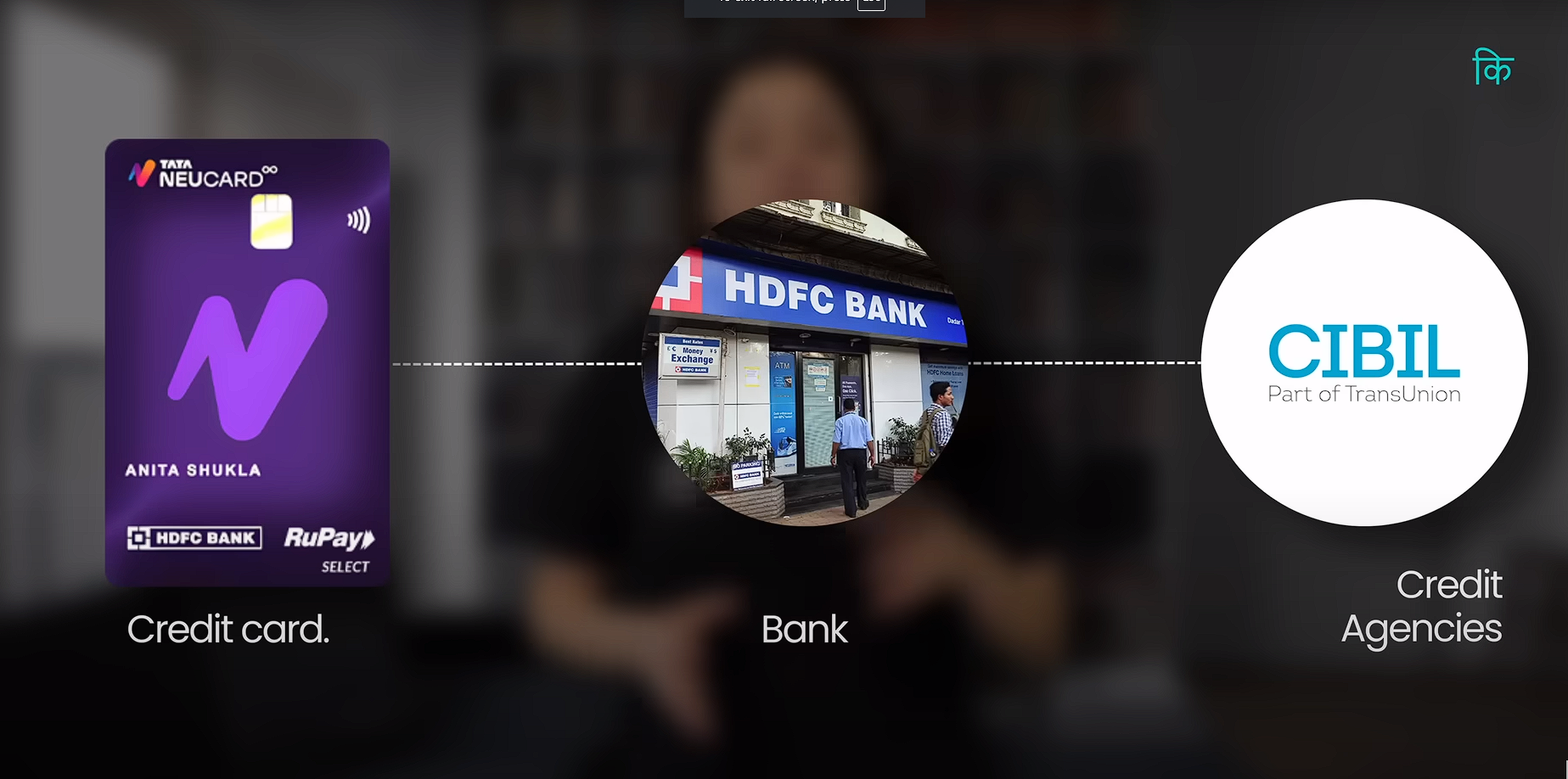

Credit bureaus like CIBIL and Experian use your credit utilization data to determine your credit score. The data shared by your bank with these bureaus reflects how much of your available credit you are using. High utilization suggests higher risk to lenders, which can result in a lower credit score.

Identifying the Right Time to Pay Your Credit Card Bill

Knowing the exact date when your bank reports your credit utilization to the credit bureaus can help you optimize your credit score. Paying your credit card bill before this reporting date can reduce your utilization ratio and potentially boost your credit score. However, different banks have different reporting schedules.

Key Dates to Consider

- Billing Cycle and Statement Date: This is when your monthly credit card bill is generated. It includes all transactions made during the billing cycle, which typically lasts 28 to 31 days.

- Due Date: This is the last date by which you must pay your bill to avoid interest charges and penalties. It usually falls 20 to 25 days after the statement date.

- Reporting Date: This is the date when your bank reports your credit utilization to the credit bureaus. This date varies by bank.

Bank-Specific Reporting Dates

- Axis Bank: Reports credit utilization on the bill generation date. Pay your bill before this date to maintain a low utilization ratio.

- SBI (State Bank of India): Reports utilization three days after the bill due date. Paying your bill before the due date ensures a lower reported utilization.

- HDFC, ICICI, and RBL Banks: Typically report on the statement date. Ensure your bill is paid before this date to optimize your credit score.

Practical Steps to Manage Credit Utilization

- Track Your Billing Cycle: Understand your billing cycle and statement date.

- Pay Early: Aim to pay your bill before the statement date or due date, depending on your bank’s reporting schedule.

- Monitor Your Credit Utilization: Regularly check your credit utilization across all your credit cards to ensure it stays below 30%.

- Join Credit Card Communities: Participate in forums and communities like B 53.2 to stay updated on best practices and gather data from other users.