Introduction

In this video, we will discuss in detail the best health insurance plans in India. This video is crucial because I will expose some terms and conditions of companies that you might not be aware of. Often, we randomly sign policies without understanding them fully. We will discuss all the ifs and buts, so make sure to like the video.

Main Companies

In India, three main companies are often discussed regarding health insurance:

- HDFC ERGO’s Optima Super Secure Plan – A very interesting plan.

- New India Assurance – Another popular option.

- Star Health Insurance – Known for its various features.

We will discuss these plans on various points and present the details to you.

Claim Settlement Ratio

If we talk about the claim settlement ratio, HDFC ERGO has a settlement ratio of 99.8% for the financial year 2020, which was a difficult year due to the COVID-19 pandemic. This demonstrates the company’s efficiency in settling claims during challenging times.

Premium Costs

Choosing a cheaper plan randomly is not advisable because health insurance supports you and your family during critical times when you are hospitalized and need financial support. Therefore, it is essential to select a plan that offers comprehensive coverage rather than just focusing on lower premiums.

Pre-Hospitalization Expenses

Suppose you are hospitalized and incur expenses before the actual hospitalization. It is crucial to know how long your policy will cover these expenses. For instance, HDFC ERGO covers pre-hospitalization expenses effectively.

Room Rent Limits

Your policy’s room rent limits can be a deciding factor. For example, HDFC ERGO offers coverage for a single standard AC room, while Star Health Insurance may have room rent limits, which can be a negative point.

Ambulance Charges

HDFC ERGO provides comprehensive coverage for ambulance charges, whether you need to travel from one city to another. New India Assurance covers up to Rs. 22,000 per hospitalization, while Star Health Insurance covers Rs. 7,750 per hospitalization with an overall policy period limit of Rs. 1,50,000.

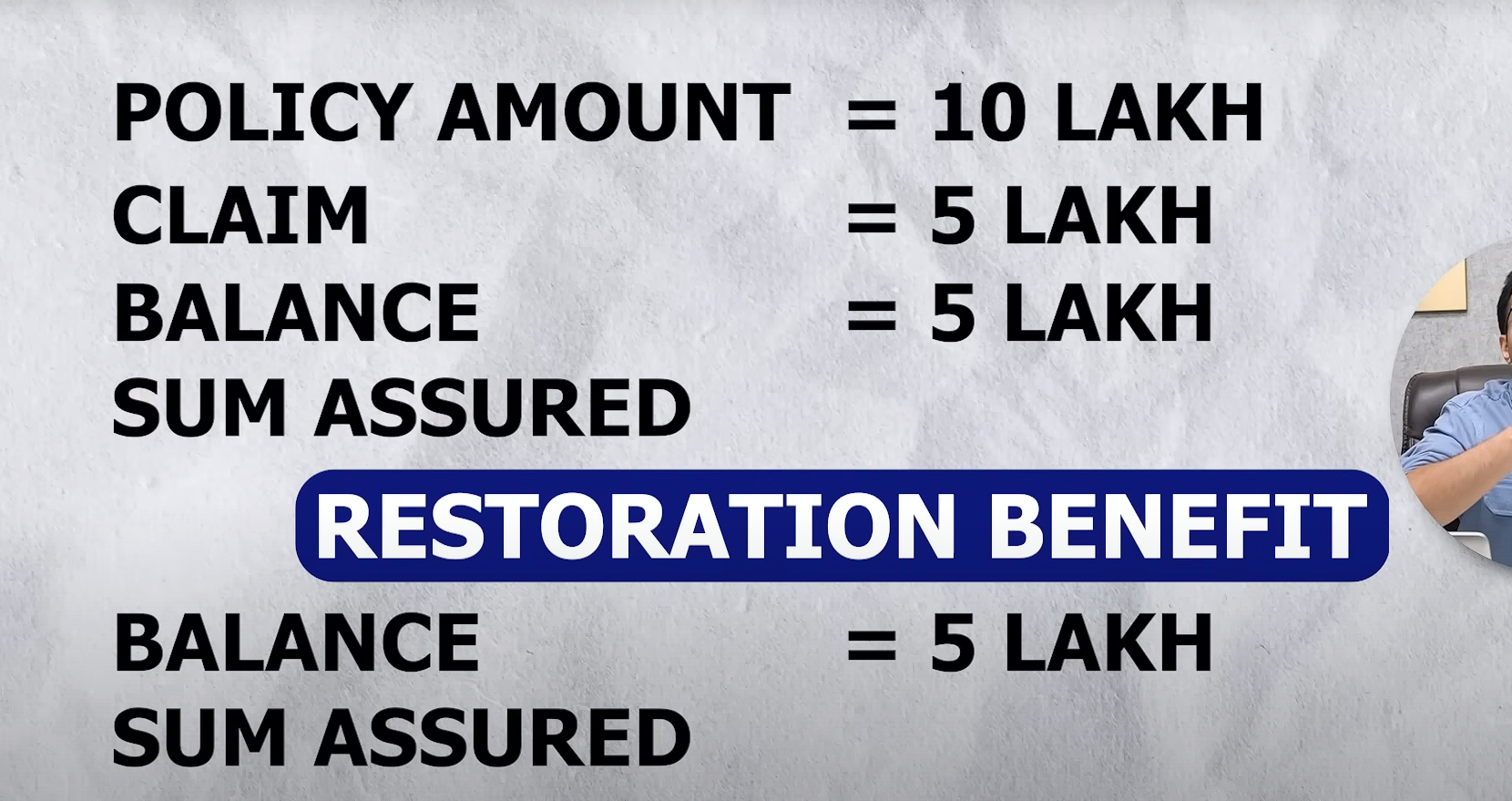

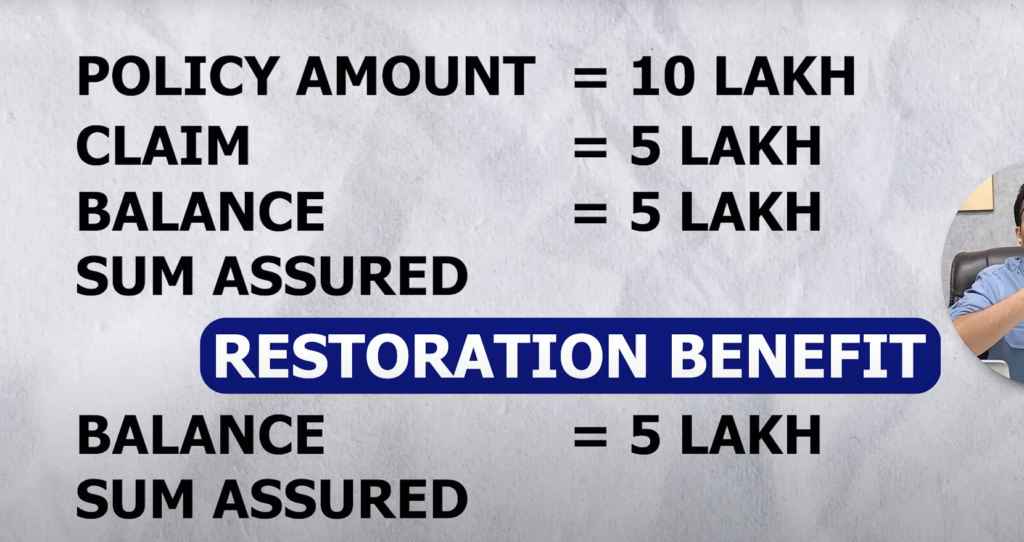

Restoration Benefits

Restoration benefits are vital. Suppose you have a policy with a sum insured of Rs. 10 lakhs and you claim Rs. 5 lakhs in a particular year. The restoration benefit ensures that your total sum insured is restored to its initial amount. HDFC ERGO offers unlimited restoration benefits, which can be beneficial.

Bonus

Bonuses are essential and can be quite complicated. HDFC ERGO offers a 50% bonus on your sum insured for the first claim-free year and 100% after two claim-free years. New India Assurance offers a 50% bonus each year if no claim is made. However, Star Health Insurance’s bonus structure is complicated and less beneficial.

Secure Benefit

HDFC ERGO provides a unique secure benefit. Suppose you have a policy of Rs. 10 lakhs, this benefit doubles your sum insured to Rs. 20 lakhs from day one.

Organ Donor Coverage

Organ donor coverage is another important factor. HDFC ERGO offers coverage for organ donors, while Star Health Insurance does not.

Hospital Network

Ensure that the major hospitals in your area are covered under the policy. HDFC ERGO has a network of over 13,000 hospitals, New India Assurance over 5,000, and Star Health Insurance over 11,000.

Robotic Surgery and Modern Treatments

HDFC ERGO covers robotic surgery and modern treatments up to Rs. 1 lakh or 50% of the sum insured, whichever is lower.

Personal Rankings

Based on all these points, my personal ranking is:

- HDFC ERGO Optima Super Secure Plan

- New India Assurance

- Star Health Insurance

If you haven’t taken a health insurance plan for your family yet, check the description and pinned comment for our team’s contact details. We will assist you in selecting the best plan, health checkups, and other requirements.

Conclusion

I hope this video helps you understand the important points of different health insurance policies. Remember, choosing the right plan involves considering various factors, not just the premium. Stay informed and make a wise decision for your family’s health and financial security.

4o