A recent Wells Fargo study reveals a stark reality: over two-thirds of Americans are tightening their belts financially, with more than half expressing deep worries about their financial situations. Michael Lear, Wells Fargo’s head of advice and planning, sheds light on these findings and their implications.

Heightened Financial Anxiety

Americans are feeling more financially constrained and worried than in previous years, a sentiment that contrasts sharply with positive economic indicators. Lear notes, “Participants in our study told us they feel more worried and constrained than ever before, especially compared to their upbringing around money.” This anxiety is manifesting in behaviors like underreporting spending and home values, and a reluctance to discuss financial matters openly.

Drivers of Financial Concern

The primary driver behind this pervasive concern is the perceived lack of disposable income after meeting essential needs. Factors such as inflation and rising borrowing costs are squeezing budgets, forcing tough financial trade-offs. Lear, a behavioral scientist, points out that constant decision-making on limited resources can exhaust the mind, contrasting sharply with the easier financial choices of past years with lower inflation and interest rates.

Generational Differences

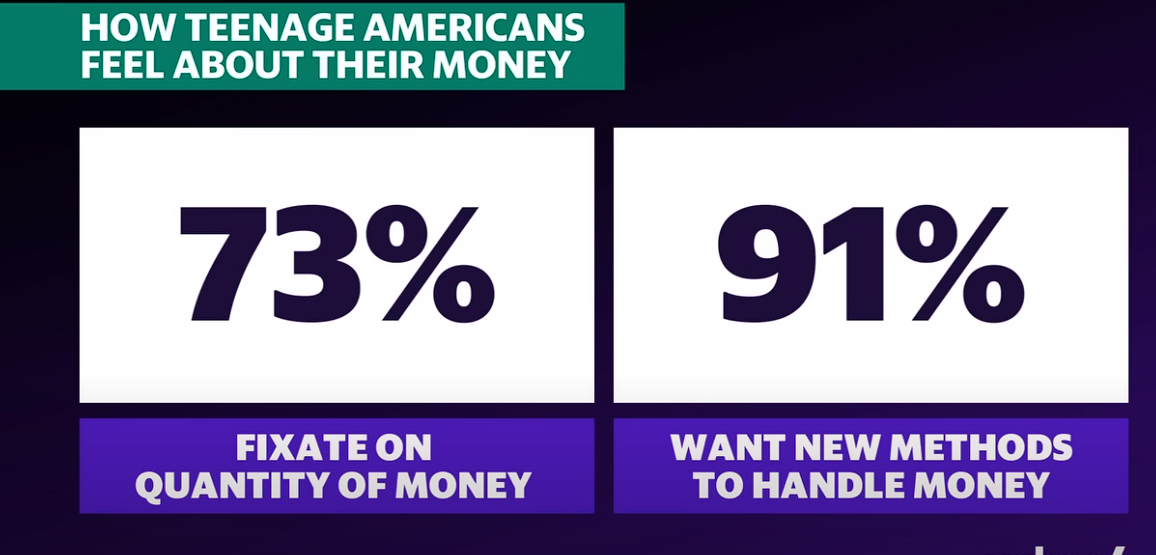

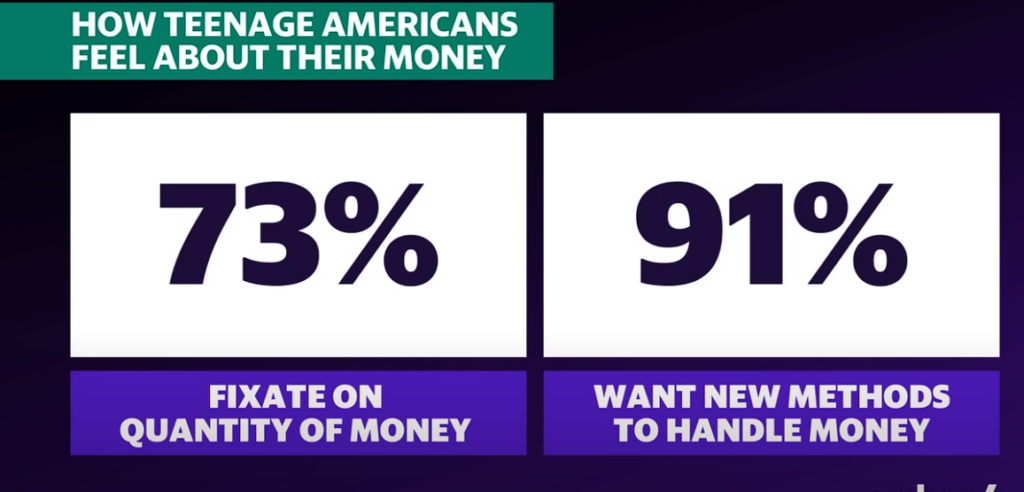

The study highlights generational variations in financial attitudes. Generation Z, in particular, stands out for its heightened anxiety regarding money matters. They feel compelled to exaggerate or hide spending habits, reflecting deep-seated financial worries. In contrast, young affluent Americans exhibit optimism despite economic pressures, demonstrating a deliberate approach to spending aligned with clear financial goals.

Perception vs. Reality

Despite positive economic data, such as consumer confidence indices, many Americans perceive economic conditions negatively. Lear attributes this discrepancy to the heightened challenges in managing day-to-day finances amidst economic unpredictability. The shift from autopilot spending to intentional financial planning reflects a broader trend towards resilience and adaptation in uncertain economic times.

Pathways to Financial Resilience

Looking ahead, the majority of survey respondents express optimism and resilience, viewing economic ups and downs as a normal part of American life. They emphasize the importance of focusing on solutions rather than dwelling on problems, advocating for sticking to savings and investment plans, and being mindful of spending habits.

Impact of External Factors

External influences, including extensive social media use and societal judgment, exacerbate financial worries among both teens and adults. Lear underscores the need for a mental reset—a shift towards taking control of personal finances and reducing the impact of external pressures.

Conclusion

The study concludes on a hopeful note, suggesting that fostering a national dialogue around financial resilience and empowerment can empower individuals, particularly younger generations, to navigate economic challenges more effectively. By focusing on what’s within their control and adopting intentional financial practices, Americans can build a more secure financial future amidst today’s uncertainties.